85% of operators may have to raise menu prices

With inflation at a 40-year high, driven by rising food prices, 85% of hospitality operators have said they may need to increase their menu prices in order to stay financially viable.

The Plates to Profits Report by Creed Foodservice surveyed directors, owners, managers and chefs in restaurants, hotels and pubs, shining a light on the ongoing impact of the pandemic, soaring food prices and the cost of living crisis on their operations.

The report reveals that 86% of UK hospitality operators will likely have to close in the next three years if their business costs don’t reduce and their revenue doesn’t increase, while half of these will likely have to close within 12 months’ time.

Philip de Ternant, managing director at Creed Foodservice, comments: "We all know the hospitality sector has taken a real hammering but to see the number of operators, who could very realistically be forced to close in the coming months, is sobering and stark.

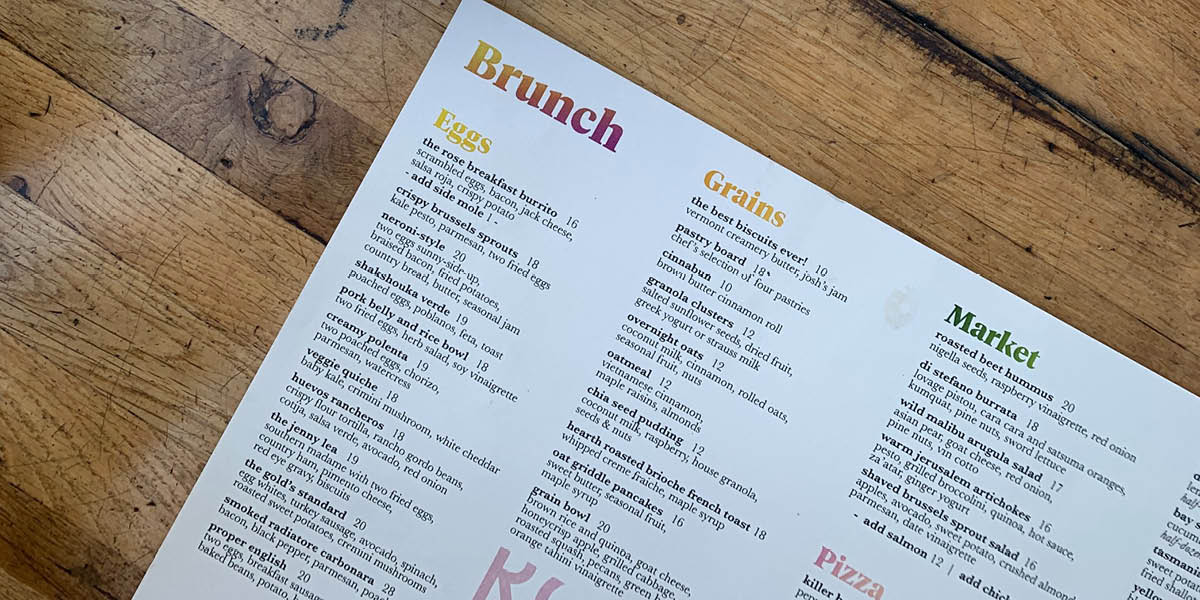

"Inflation and rising food costs are affecting the entire supply chain, from suppliers, logistics companies, transportation, the front line such as restaurants, pubs and hotels, and wholesalers like us. Over the last year we've seen a 27% increase on eggs and baking potatoes, another staple, has risen by £8 a case.

"Combine this with consumers who are also having to review their expenditure – nearly half of operators told us that the number of bookings at their establishment have reduced – the pressure mounts even more."

Unsurprisingly, two-thirds (63%) of operators said business concerns around revenue and profit have impacted their mental health over the past 12 months.

Ternant continues: "Our Plates to Profits Report is in part about genuinely understanding what state the sector is in but more so about giving operators advice, guidance and actionable ideas on how they can increase the profit on every plate they serve and drive maximum revenue into their establishment.

"The vast majority of operators (85%) told us they will need to increase their menu prices to stay financially viable. However, 83% are worried that if they do this it will alienate consumers and put them off visiting their establishment. They feel stuck between a rock and hard place.

"We’ve worked with our insights team, chefs, category specialists and senior figures to look at every aspect of an operation; from reducing food waste, maximising margins on dishes, navigating staff shortages to still create quality dishes, communicating the story behind the menu to consumers, utilising seasonal produce, recipe ideas and increasing prices through offering premium sides, high-quality specials and set-menus. We’ve also liaised with some of our restaurant and pub customers who have also contributed thoughts to the report.

"What is one of the most uplifting aspects of the report is how it’s shown us the sector’s fighting spirit is well and truly alive," Ternant concludes. "We’re seeing some really great innovation coming through; both from the report findings and also what we’re seeing when we’re out visiting customers."